HOW MUCH IS GOLD QUARTER WORTH ?

Is It Best To Sell Your Gold Quarters Now, Or Hold For a Longer-Term Investment ?

Are you wondering how much your gold quarters are worth and whether it would be best to sell them now or hold for a longer-term investment?

A gold quarter coin is one of the best and most reliable investment choices if you are in the gold market for a long-term investment that is sure to pay off in the future.

With rising inflation, economic instability, volatile stock market, and recent geopolitical uncertainty, now could be the best time to diversify your retirement savings beyond cash, stocks, and bonds. Investing in gold, silver, palladium, and platinum rare coins or bars by using a gold IRA can be one of the best options available to you.

The gold price has historically been able to successfully withstand inflation, which is one of the reasons why any form of precious metal investment is a lucrative investment at the moment.

For tax reasons, we recommend investing in gold through a Gold IRA. Detailed step-by-step guide you can get here...

As a first step, it is important to understand the difference between gold-plated quarters and gold quarters, since gold quarters are much more valuable.

HOW MUCH ARE THE GOLD-PLATED QUARTERS WORTH?

WHAT IS A GOLD-PLATED QUARTER?

You might have seen advertisements on TV stating that gold-plated quarters are extremely valuable and rare. There was a time when many people invested their money in these quarters during the late 1990s and the early 2000s with the expectation that they would be considered valuable investments in the future, which would lead to favorable returns.

Sadly, most of these quarters do not contain large amounts of gold – usually under .003 inches thick - but are simply ordinary quarters plated with a small amount of gold. When it came time to sell these supposedly special coins, those who hoped to profit were most certainly disappointed.

HOW MUCH IS THE GOLD-PLATED QUARTER WORTH?

Gold-plated quarters are advertised as rare collectibles, but they aren't worth much more than their face value because the amount of gold that has been plated on them is quite small (.003" thin layer of gold is smaller than a single hair of a human). As a result, their melt value is very low. There may be some buyers who will offer a small markup of 5 or 10 cents, but in most cases, they will not offer more than the face value of the quarters.

Considering the fact that it is so common for gold-plated quarters to be misbranded as gold coins, you might be wondering why they aren't illegal. According to U.S. currency law, the coins aren't illegal since they have not been explicitly defaced for the purpose of counterfeiting. You might think of them as a work of art, that was purely modified for the sake of aesthetics.

HOW MUCH IS THE GOLD QUARTER WORTH?

WHAT IS A GOLD QUARTER?

The value of a gold quarter, on the other hand, is much higher than the value of a gold-plated quarter. A genuine gold quarter contains a larger amount of gold. It is important to note that gold quarters are different from gold quarter eagles, which are also made of gold but are worth significantly more than gold quarters.

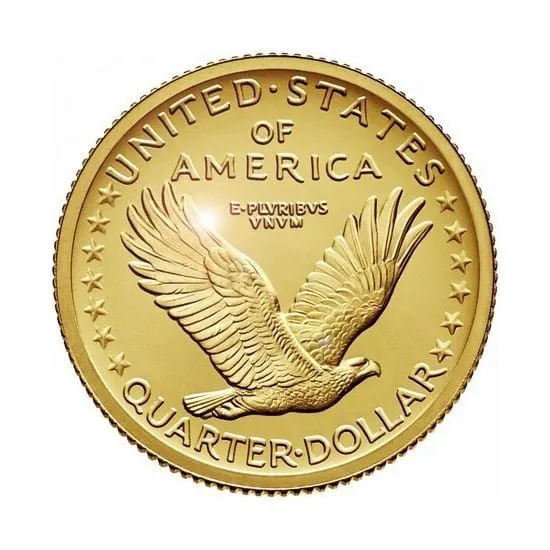

There was only one gold quarter ever authorized for circulation, and that is the Standing Liberty Centennial Gold Quarter Coin that was issued in 2016 to commemorate the 100th anniversary of the design of the Standing Liberty quarter.

The Gold Standing Liberty Centennial Coin:

-

Is composed of 24-karat gold with a 99.99% purity

-

Its face value is 25 cents

-

Has a weight of .25 troy ounces (7.775869 Grams)

-

Its obverse side is marked with a "W" to indicate its minting location in West Point, New York

In total, there have been 91,752 Standing Liberty Centennial coins minted.

HOW MUCH IS THE GOLD QUARTER WORTH?

Gold quarters, despite only having the face value of a common quarter, are valuable collectible items that are worth significantly more than the face value of the coin.

Aftermarket prices for gold coins are based on their underlying melt value, which is set by current gold spot prices. The Standing Liberty Centennial coins contain .25 ounces of gold, so they are worth 1/4 (25%) of the price of one-ounce gold bullion bars.

Currently, the spot price of pure gold is $1,768.00, meaning that a Standing Liberty Centennial Gold Coin could be valued at $340-$560. There are, of course, other factors other than its gold value that may affect how much a coin is worth (for instance, its condition). But due to their gold content, these coins are always worth more than their face value of 25 cents.

THE BEST 15 GOLD COINS TO BUY AND INVEST

1. Gold U.S. American Eagle Coin

2. U.S. Saint Gaudens Double Eagle Coin

3. 1/10 oz United States American Gold Eagle Coin

4. Gold Canadian Maple Leaf Coin

5. Gold Chinese Panda Coin

6. Gold Austrian Philharmonic Coin

7. Gold British Britannia Coin

8. Gold Australian Kangaroo Coin

9. Gold British Sovereign Coin

10. Gold French Rooster Coin

11. Gold American Buffalo Coin

12. Gold Mexican Libertad Coin

13. Gold Somalian Elephant Coin

14. British Royal Mint Gold Standard Coin

15. Gold South African Krugerrand Coin

THE GOLD IRA:

BENEFITS AND TAX ADVANTAGES OF INVESTING IN GOLD

1. TAX DEFERMENT

Gold IRAs are a great way to invest in gold and other precious metals as they allow you to keep gold coins and gold bullion in an IRA account that you fully control. Check out our guide to IRS-approved gold and silver coins and bullion bars to find out what types of gold coins and bullion gold bars are allowed to buy by the Silver and Gold IRS tax rules.

A Traditional Gold IRA is just like other types of IRAs in that taxes are deferred until distributions are made. Gold coins and bullion can be contributed tax-free to a Gold IRA.

2. INHERITANCE TAX RELIEF

3. TAX CREDIT FOR SAVERS

According to the IRS, you might be able to take a tax credit of up to 50% based on the amount you contribute to your Gold IRA. This type of credit is known as the Retirement Savings Contribution Credit or Savers Credit.

How to Own Gold Bars and Coins in

a Tax-Advantaged Manner ?

Most people don't realize that you can invest in gold bullion bars easily through your self-directed IRAs or 401Ks.

The advantage here is that you are able to own pure bullion bars in a tax-advantaged manner, while still protecting your portfolio from financial risks like inflation, stock market crashes, and political turmoil that may occur in the future.

To learn more and avoid any tax penalties, we highly recommend that you request the free Gold IRA guide explaining all the needed steps and how to avoid any possible IRS penalties ...

Concerned About Record Inflation,

Volatile Stock Market and Broken Economy ?

Protect Your Retirement - Request Your FREE Gold IRA Guide Today

Learn The Secrets Americans Are Using to Protect Their Retirement Savings

-

HOW TO OPEN A GOLD IRA TAX & PENALTY FREE

-

HOW YOU CAN GROW YOUR RETIREMENT

-

HOW TO AVOID ANY POSSIBLE IRS PENALTIES

FTC Disclosure: We are a professional and independent website dedicated to providing valuable information for people interested in retirement investing. Our content does NOT constitute financial advice, we are not financial advisors. All investments are your own decisions. Please conduct your own research and seek advice from a licensed financial advisor before making any investment decision. In addition, in order to cover the costs of running this website, we do receive compensation from ads and banners you see on the site. We also receive compensation from leads we refer to external companies.